LONDON – Linear television viewing is declining across major European markets, driving a corresponding drop in advertising spend, says Andy Jones, VP of broadcast and connected television, EMEA, at PubMatic.

The shift is consistent across regions and no longer disputed by buyers or sellers, he said in this interview with Beet.TV contributor Robert Andrews at the Future of TV Advertising Global conference.

The key question now is where attention and investment are moving instead. Those changes can be grouped into four distinct advertising destinations.

Broadcaster VOD and streaming extend TV reach

The first destination is broadcaster video-on-demand, as European broadcasters expand apps and platforms to make content available on demand. Broadcaster VOD remains closely tied to traditional brand campaigns and linear creative.

The second destination is paid streaming, including ad-supported tiers from services such as Netflix and Disney. Free ad-supported streaming television channels are also growing, particularly through smart-TV manufacturers.

Jones said both categories mainly extend linear TV campaigns rather than replace them.

Social and retail dominate new ad spend

The most significant growth, Jones said, is occurring in social video and retail-linked advertising. Social video is led by platforms such as YouTube and TikTok.

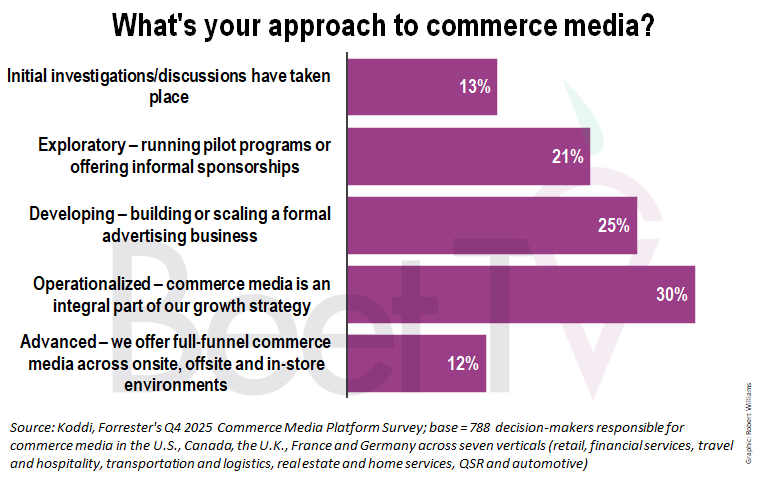

Retail and commerce media are also expanding rapidly across Europe. These channels are digital-first and focus on performance branding rather than pure reach.

Jones said 91% of new advertising money is flowing to just four companies, which dominate social and retail media. That concentration has made the market highly competitive.

Supply path cleanup and AI adoption accelerate

Behind the scenes, Jones said progress has been strongest in what’s known as supply path optimization, or the process of reducing intermediaries in programmatic advertising to improve efficiency, transparency, performance and cost control for buyers and publishers.

Artificial intelligence is shifting from theory to operational reality as publishers and platforms reduce resellers and moving toward more direct connections, he said. AI is simplifying campaign execution, optimization and troubleshooting across programmatic workflows.

AI moves from buzzword to infrastructure

Jones said the most successful platforms embed AI throughout their technology stack. PubMatic’s partnership with NVIDIA underpins its AI-driven capabilities, he said.

AI improves campaign setup speed, delivery efficiency, and issue resolution. Buyers are responding positively to more intuitive tools across the programmatic chain.

IP-delivered TV shapes the next phase

Looking ahead to 2026, Jones said IP-delivered television represents the biggest opportunity for connected TV. He said the goal is combining linear TV’s brand impact with digital performance measurement.

One focus area is programmatic monetization of live broadcast imagery. Jones said technical infrastructure is already in place, with testing underway alongside select broadcasters.

New formats, data and scale drive growth

Jones said new CTV formats such as pause ads, squeeze-backs, and overlays could attract incremental ad budgets. Greater data availability, including commerce and retail partnerships, will further improve targeting and measurement.

Continued growth in streaming audiences will expand supply and improve inventory quality. Jones said those factors position the TV advertising market for a strong year ahead.